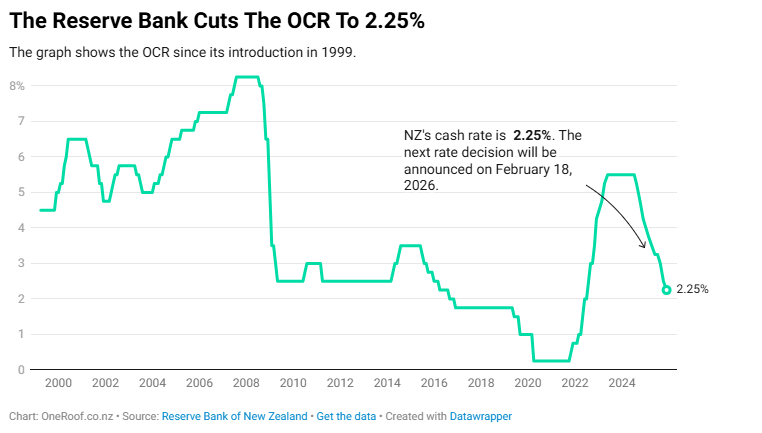

Tony Alexander’s recent analysis sheds light on the Reserve Bank’s significant moves in 2025, particularly the Official Cash Rate (OCR) falling from 4.25% to a new low of 2.25%. This drop, including the latest 0.25% cut, marks a substantial shift, bringing home loans to more affordable levels.

Key Takeaways from the OCR Cut:

- Economic Landscape: While the economy is showing initial signs of recovery, there’s still a notable amount of “spare capacity,” which generally points to higher unemployment. The Reserve Bank believes this spare capacity will help guide inflation down from its current 3% towards the 2% target.

- Cautious Outlook on Growth: The Bank noted several potential downsides for growth, including concerns about China’s economy, the sustainability of AI optimism, cautious consumer spending, and an expectation of only mild house price increases moving forward.

- The Undercurrents: Inflationary Risks: Interestingly, Alexander highlights the frequent mention of upside risks to inflation. These include New Zealand’s low productivity growth (meaning inflation could appear even with mild economic growth), elevated household inflation expectations, businesses planning to raise prices to restore margins, the global politicization of central banks, and potential stronger-than-expected reactions to interest rate cuts.

- Interest Rate Cycle – At the Bottom?: The general consensus is that we’ve likely hit the bottom of the interest rate cycle. However, this doesn’t automatically mean rates will rise immediately. The economy’s current spare capacity means there’s room for growth before significant rate hikes are needed.

- What Drives Growth in 2026-2027?: Looking ahead, several factors are expected to fuel economic growth, such as higher farm incomes, the delayed impact of low interest rates, increased tourism and foreign students, infrastructure investments, more house building, and a recovery in household and business spending.

Tony Alexander’s Personal Recommendation:

For those looking to borrow right now, Tony Alexander suggests considering fixing your mortgage interest rate for 3 to 5 years. Given the ongoing uncertainties, especially globally, he also recommends splitting across a couple of terms to spread the risk.

Source from oneroof.co.nz: https://www.oneroof.co.nz/news/tony-alexander-what-the-ocr-drop-to-2-25-means-for-mortgages-and-house-prices-in-2026-48638

The opinions and research contained in this article are provided for information purposes only, are intended to be general in nature, and do not take into account your financial situation or goals.