Interest rates, after peaking in mid-2024, trended downwards throughout 2025, bringing great relief to many mortgage holders. But what does 2026 and beyond hold? To help you make informed decisions about your home loan, we’ve compiled interest rate predictions from New Zealand’s leading experts!

Expert Predictions: Rates Bottoming Out, Then Stabilizing!

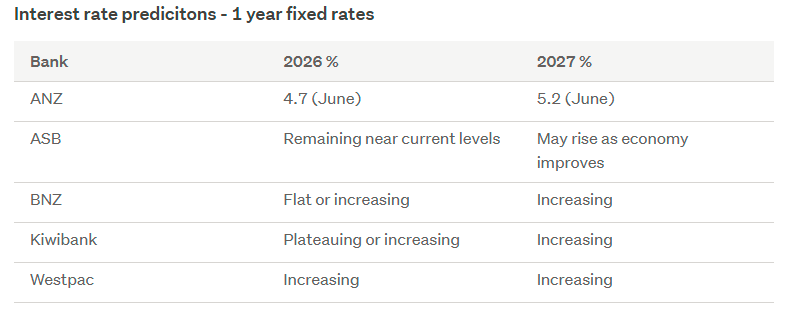

It’s official – forecasters are largely in agreement that we’ve reached the bottom of the interest rate cycle, with most one-year rates currently in the mid-to-low 4s.

- Early 2026: Six-month and one-year rates may see a slight further drop following the November OCR cut.

- Mid-2026 Onwards: After this, rates are expected to either plateau or gradually increase throughout 2026 and 2027.

- Longer-term Rates: Longer-term fixed rates (like 2, 3, and 5 years) are already on the rise.

Most banks anticipate that the Official Cash Rate (OCR) has bottomed out by the end of 2025, with rates gradually increasing from 2026. ANZ and Westpac, in particular, advise that 2- and 3-year fixed rates offer good value right now, suggesting that fixing for longer terms could insulate borrowers from future OCR hikes. ASB highlights a potentially significant point: interest rates are likely to settle in a much higher range than they have since COVID, which is crucial for long-term financial planning.

Key Takeaways: Market Volatility & Expert Advice

Remember, these forecasts are based on current information. Both the global and domestic economies face various headwinds that could shift these predictions at any moment.

Furthermore, lenders’ advertised rates are often higher than the actual rates many customers receive. To ensure you secure the best available rate from your lender, it’s highly recommended to speak with a mortgage broker or banker!

Source from trademe: by Ben Tutty.

Additional commentary from him can be found at https://www.trademe.co.nz/c/property/article/Interest-rate-predictions?srsltid=AfmBOoryNakW8TcL3lAEGnxgxE6ZDbbT3WuoxYD9QPbzdvkxPJtBSQmY

The opinions and research contained in this article are provided for information purposes only, are intended to be general in nature, and do not take into account your financial situation or goals