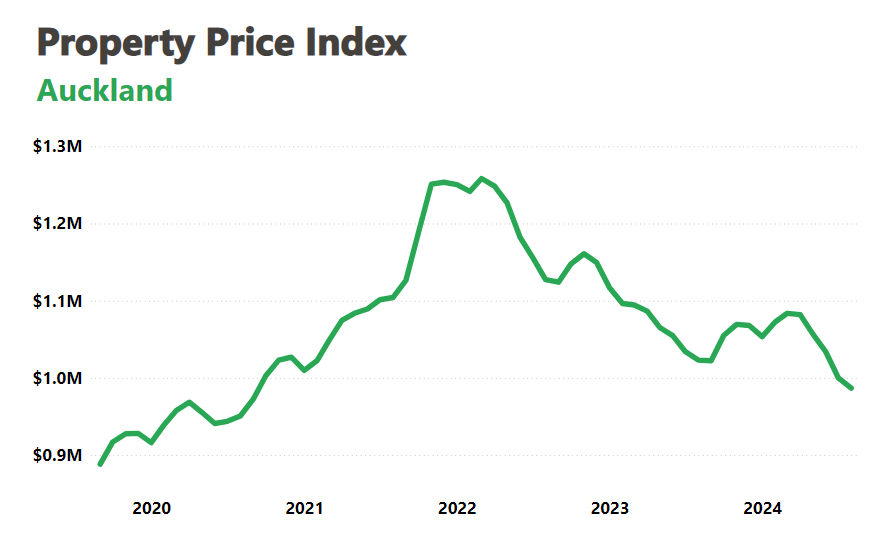

The average asking price for properties in Auckland has fallen below $1 million for the first time in nearly four years, reaching $986,750 in August 2024, which is a 1.3% decline from July. This marks the first time since September 2020 that prices in the region have dipped below this threshold and reflects a broader trend, as August represents the fifth consecutive month of declining prices. Trade Me Property’s Customer Director, Gavin Lloyd, noted that the upcoming September data will be crucial in determining whether this decline is simply a seasonal adjustment or indicative of more serious structural weaknesses in the housing market.

Nationally, the average asking price also decreased, falling 0.8% month-on-month and 2.3% year-on-year to $818,250. If this trend continues, Lloyd suggests that average prices could drop below $800,000. Despite these declines, five regions saw year-on-year increases, predominantly in the South Island, while Gisborne was the only North Island area to experience positive movement.

Larger properties have also seen a decline in prices, with homes of five or more bedrooms down 3.4% to an average of $1,396,250. This trend reflects broader challenges in the housing market, particularly for higher-end properties, as areas like Wellington and Auckland recorded significant price drops. Overall, the current market conditions may present a favorable opportunity for buyers looking to enter the market amidst the ongoing price adjustments.

Source from trademe.co.nz: https://www.trademe.co.nz/c/community/news/property-price-index-august-2024?srsltid=AfmBOooFbLZ3mF7WuP7_kn75YNkH6nI4GwBlaDnJahqElW_vvouPM4kQ

The opinions and research contained in this article are provided for information purposes only, are intended to be general in nature, and do not take into account your financial situation or goals.