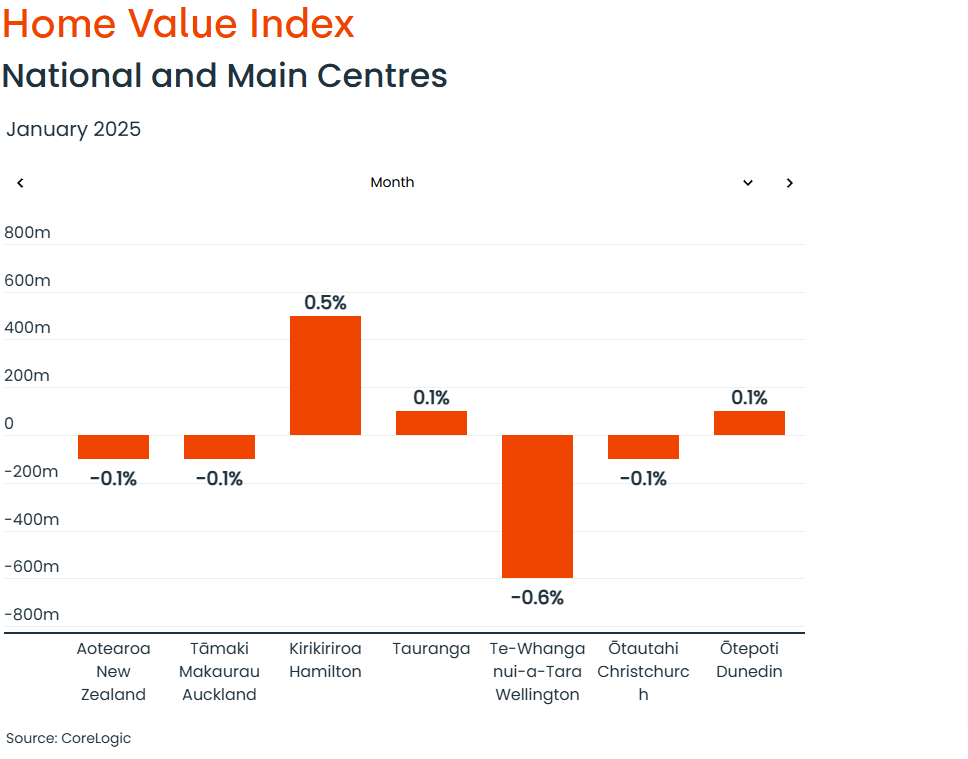

In January, property values in Aotearoa New Zealand decreased by 0.1%, marking the fifth consecutive month of limited movement. The CoreLogic Home Value Index (HVI) indicates that, after a cumulative decline of 4.1% from March to August, there has only been a further drop of 0.4% since then, suggesting a potential rebound in prices.

The national median property value is now $803,819, which is 17.5% lower than the record highs of late 2021/early 2022, yet still 16.3% above the pre-COVID level from March 2020. In January, most major centers experienced flat performance, with Tauranga and Ōtepoti Dunedin growing by 0.1%, while Tāmaki Makaurau Auckland and Ōtautahi Christchurch saw a decline of 0.1%. Kirikiriroa Hamilton stood out with a 0.5% increase, whereas Te Whanganui-a-Tara Wellington declined by 0.6%.

Kelvin Davidson, Chief Property Economist at CoreLogic NZ, noted that the recent stability in property values might indicate future growth potential. He observed that mortgage rates have significantly dropped, leading to increased property sales, which may reduce available listings and create competitive pressure among buyers, potentially driving prices up again.

However, he advised caution, as not all areas are showing stability, particularly Wellington. The soft economy and subdued labor market suggest that a sharp increase in values is unlikely, and upcoming debt-to-income ratio caps may further dampen the market in 2025.

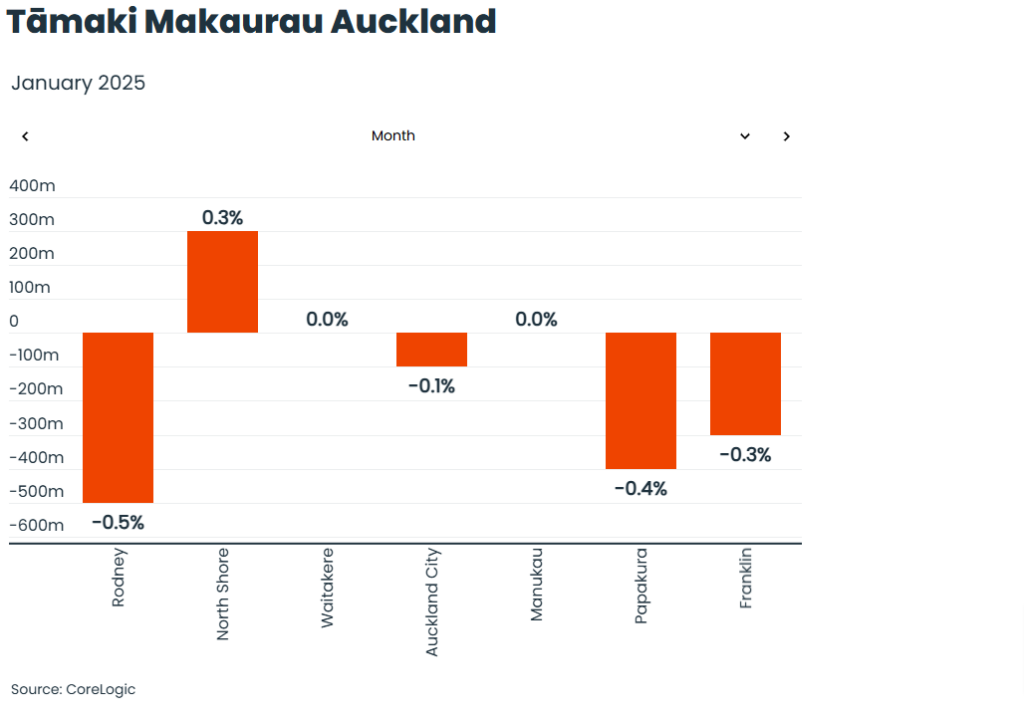

In Tāmaki Makaurau Auckland, sub-markets exhibited mixed results in January, with North Shore rising by 0.3% and other areas remaining flat or declining. Over the past three months, North Shore and Waitakere showed signs of growth, but many parts of Auckland are still experiencing downward momentum. Davidson highlighted that North Shore could be a key indicator for the rest of the city in the coming months, but with ample buyer choice and new properties being completed, a broad-based upturn is not expected soon.

Source from corelogic.co.nz: https://www.corelogic.co.nz/news-research/news/2025/housing-market-close-to-a-trough

The opinions and research contained in this article are provided for information purposes only, are intended to be general in nature, and do not take into account your financial situation or goals.