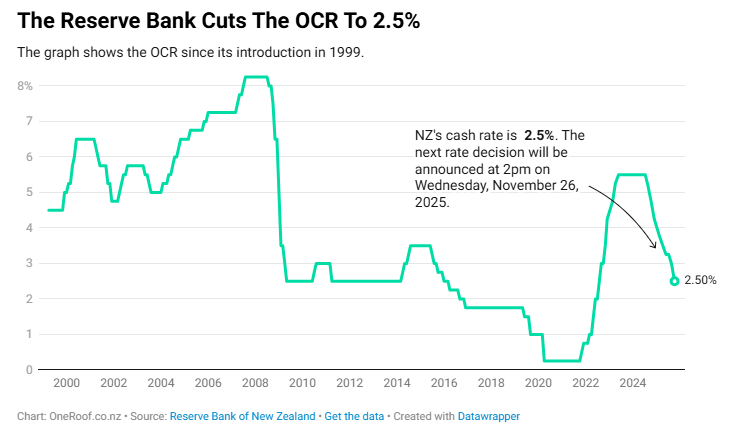

Following the Reserve Bank’s recent decision to slash the Official Cash Rate (OCR) by 0.5 percentage points to 2.5%, the question on everyone’s mind is: what will be the real impact on our economy? Economist Tony Alexander’s latest surveys offer some early insights, suggesting a slightly more positive outlook.

Consumer Spending: A Glimmer of Hope? Consumer spending intentions have shown a notable rebound. After a challenging period, the net percentage of people planning to buy more in the next 3-6 months has risen to +13%. This is the best reading in nearly four years, signaling a potential “light at the end of the tunnel” for retailers. However, this boost in consumer spending could remain constrained until the job market strengthens, as employment insecurity still weighs on consumer confidence.

Business Outlook: Cautious Optimism Businesses are also expressing a little more optimism regarding future revenues, with the net proportion expecting better revenue in a year rising to 53% from 48%. While this direction is positive, the improvement is modest. Interestingly, plans for new investment in plant and machinery have seen a slight dip, and planned stock levels have worsened. On the employment front, there’s a small hint of positivity as plans to increase remuneration have risen to 22%. However, the labor market typically lags the economic cycle, so more significant shifts might not be apparent until the New Year, potentially driven by higher farm incomes and sustained lower interest rates.

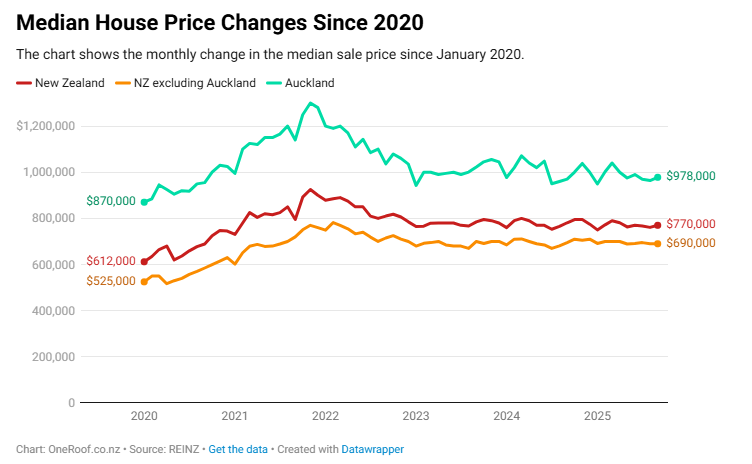

The Housing Market: Steadying, Not Soaring Yet For the housing market, the focus is now on whether owner-occupiers will join the active first-home buyers who have been prominent since early 2023. A strong labor market is crucial for this next step. While lower financing costs will provide some relief for investors, helping to offset rising council rates, maintenance, and insurance, continued weak net migration and falling rents could act as restraints.

Good news, though! The latest data suggests that house prices have at least stopped falling and are beginning to creep slightly higher. The REINZ House Price Index saw a 0.8% rise in September after a 0.4% gain in August. While these gains effectively offset previous declines, it points to a period of stabilization, which seems to be the most sensible expectation for now.

In summary, while there are early signs of positive shifts in consumer and business sentiment due to the OCR cut, a robust and rapid economic boost, especially in the housing market, seems to be a little further down the road.

Source from Oneroof: by Tony Alexander

Additional commentary from him can be found at https://www.oneroof.co.nz/news/tony-alexander-reserve-banks-ocr-shock-treatment-is-it-working-48362

The opinions and research contained in this article are provided for information purposes only, are intended to be general in nature, and do not take into account your financial situation or goals.